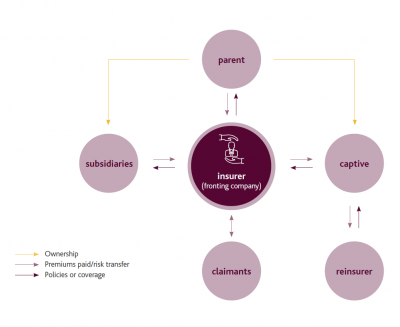

The vast majority of reinsurance companies in Luxembourg are of the “captive” type which means they are subsidiaries of international groups and their principal objective is that of reinsuring the risks of the other companies in the group. Captive reinsurance is essentially an “in-house” insurance entity created to insure the parent company and its affiliated companies.

There is no difference in the European and Luxembourg domestic legislation between standard reinsurance companies and captives, both in terms of activities and taxation, but a captive largely restricts its activities to reinsuring other members of its group. Both captives and non-captives operate in a regulatory framework defined at the EU level by the Reinsurance Directive, transposed into Luxembourg legislation in December 2007, and by the Solvency II Directive, transposed in December 2015.

A LEADING REINSURANCE HUB IN EUROPE

Luxembourg is the largest captive reinsurance market in the EU. International companies from all over the world have established around 200 reinsurance undertakings in the Grand Duchy.

There are several benefits of captive reinsurance. The premiums paid to the captive by the parent and affiliates of the group and the attached captive’s underwriting profits can be retained within the international group and used to finance the business activities of the other subsidiaries of the group.

The captive reinsurance, being an “in-house” reinsurance solution, allows its owner to tailor the insurance to suit the group’s specific requirements. In particular, international groups with different types of risks in different geographic locations may often have to purchase insurance policies from local providers. A captive can create a “one-stop shop” within the group, enabling the owner of the captive to allocate deductibles for each risk or territory.

The captive also centralises the risk management strategy of the international group, allowing for a better overall assessment of the group’s risk exposure and losses.

INSURANCE:

A LEADING FINANCIAL CENTRE IN EUROPE

-

Insurance in Luxembourg

The Luxembourg financial centre provides a wide range of financial services, acting as a bridge between global investors and markets.

Read More -

Freedom of Services in the EU

The Freedom of Services regime, introduced by the third EU life and non-life insurance directives and transposed into Luxembourg legislation.

Read More -

A Dedicated Insurance Regulator

The recent introduction of the European Solvency II regime in 2016 substantially changed the Luxembourg regulatory framework for the insurance and reinsurance sector.

Read More -

An International Life Insurance Hub in Europe

Luxembourg is the leading financial centre for the distribution of cross-border life insurance products in the Eurozone.

Read More

-

Non-life Insurance Gaining Strong Momentum

Luxembourg’s traditional strengths in the insurance sector have been in the life and reinsurance domains.

Read More -

Luxembourg Reinsurance

Luxembourg is the largest captive reinsurance market in the EU. International companies from all over the world have established around 200 reinsurance undertakings in the Grand Duchy.

Read More -

Future Challenges for the Insurance Industry

The companies that make up the insurance industry together make up the largest group of institutional investors in Europe.

Read More