+125

International banks from 27 countries

€395 billion

Private Banking Assets under Management (AuM)

€ 4.5 trillion

in assets under management (as of April 2020), Luxembourg is the number one investment fund centre in Europe and second worldwide. It is the undisputed global leader in the cross-border distribution of funds.

Banks in Luxembourg have established several areas of expertise, including private and institutional wealth management, corporate banking, retail and commercial banking, as well as a full range of investment fund services.

The EU passport allows banks in Luxembourg to offer their services throughout the European Single Market

Luxembourg offers bespoke structures for all the main alternative asset classes and investment strategies, including

J.P. Morgan recently established its Wealth Management business headquarters in the Grand Duchy. This has allowed us to seamlessly support clients in multiple EU markets with goals-based, bespoke private banking advice and counsel.

It takes a special expertise to understand the legal, fiscal and financial implications of living international lives and managing investments across borders.

RISING ASSETS UNDER MANAGEMENT

Private banking assets in Luxembourg totalled EUR395 billion at the end of 2018, 76 percent higher than the amount recorded just before the onset of the financial crisis in 2008 (EUR 225 billion). This decade of continuous growth in private banking assets is a clear vote of confidence in the expertise of Luxembourg’s wealth management professionals.

Family Offices - Luxembourg's ecosystem offers the complete spectrum of services

Luxembourg is one of the few countries to offer institutional solutions to ultra-high net worth families. The unique range of legal solutions and of regulated and unregulated vehicles facilitates the organisation of their assets.

More and more international families create their investment vehicle in Luxembourg to administer their interests in Europe or internationally.

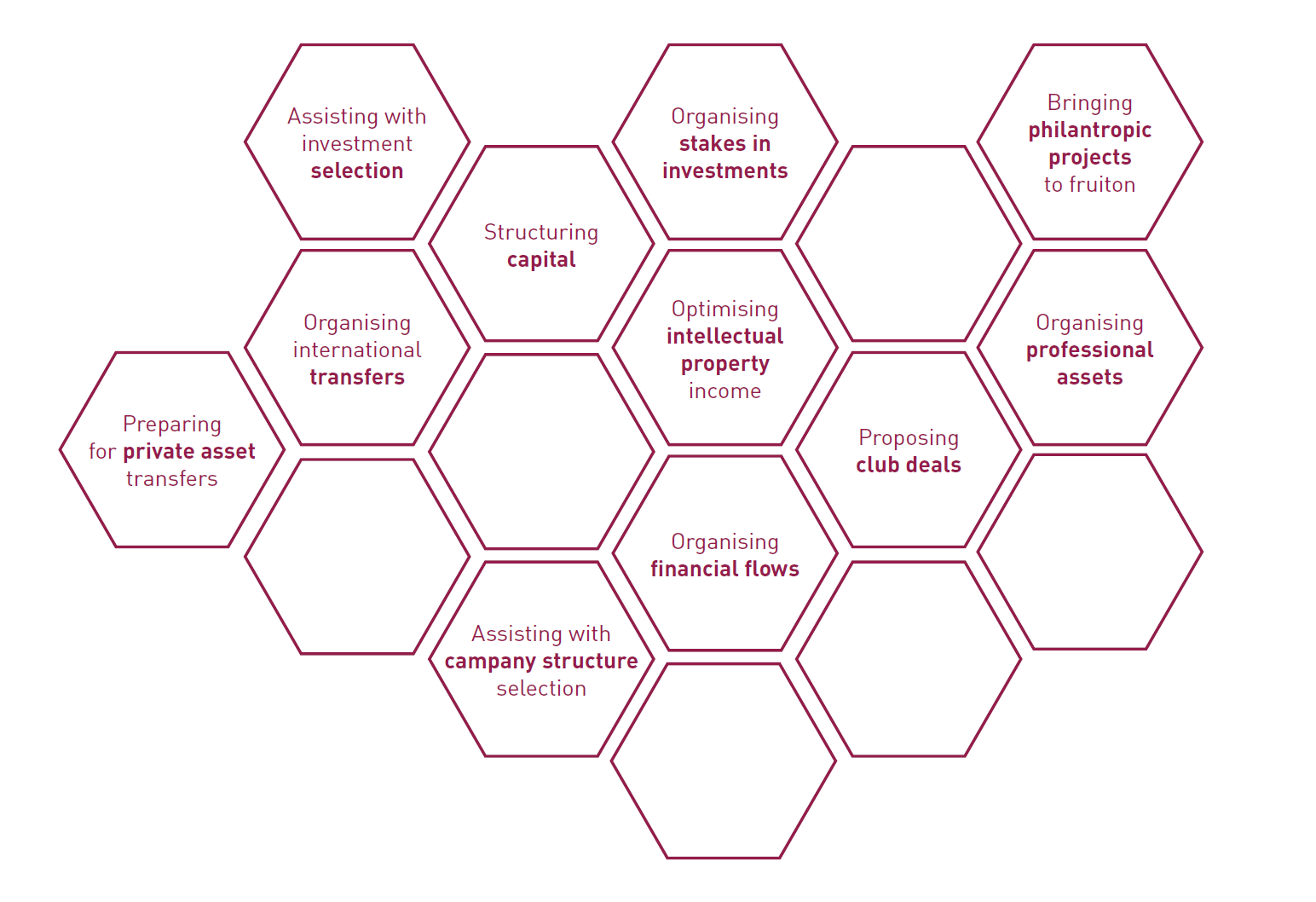

A diversified toolbox for wealth management

Wealth management professionals rely on a comprehensive “toolbox” of well-designed legal instruments. Precise solutions can be crafted for each family’s unique cross-border financial and estate management needs. Depending on the individual’s requirements, options include

flexible, non-regulated solutions, specialised investment funds or risk capital investment companies. A range of contractual tools, such as fiduciary agreements and insurance products is also available.

Luxembourg's regulatory framework

Like any other global banking centre, the Luxembourg financial centre has undergone profound structural changes, driven by supranational regulation. Private banks have embarked on a journey to implement these new standards, creating a need for significant adjustments to bank business models and even more so in cross-border wealth management.

Digital trends

Wealth Management is set to welcome a new generation of clients. They have new attitudes and expectations of the wealth management business and they think differently about advisory services. Wealth management is a people business and is founded on personal

trust. Nevertheless, technology, used wisely, can strengthen these relationships and improve customer experience. Luxembourg is committed to leading the drive towards digital financial services.

Alternative investment trends

Luxembourg is well known for being an international hub for Private Equity (PE) deals and attracts an increasing number of PE houses. According to Preqin, a leading data provider for the alternative asset community, 19 out of the top 20 Private Equity firms and General Partners worldwide have operations in Luxembourg. This market is expected to grow at least 10 percent annually in the coming years.